The digital advertising space has officially been flipped upside down. Over the past 27 months, we’ve seen new regulations like GDPR (May 2018), the California Consumer Privacy Act (January 2020), and, most recently, Apple’s announcement of “opt-in for IDFA” (June 2020, will go into effect in September) redefine online identification, ad attribution, and customer matching across the globe.

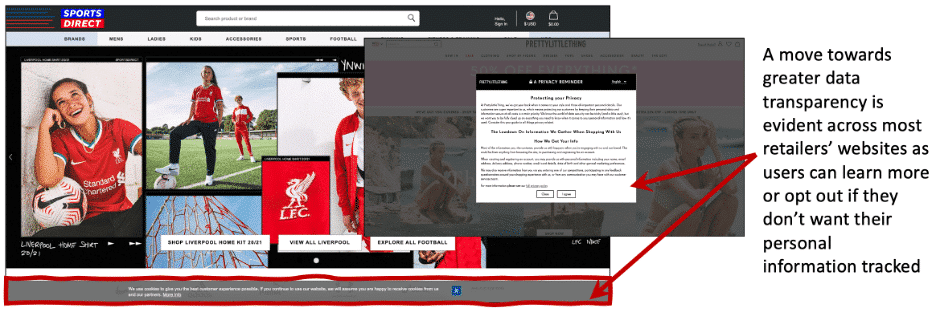

As consumers clamor for greater ad transparency and control over how their personal data will be used, advertisers need new ways to do better targeting armed with less. As the latest Gartner Hype Cycle for Digital Advertising, 2020 put it, “Consumer brands face a growing trust crisis that threatens profitability and depletes brand value. As privacy regulations force brands to obtain advance consent for each instance of personal data processing, the risk of habitual declines threatens to deprive marketers of their ability to offer personalized services and anticipate customer needs based on observed behavior.”

Now Google is getting into the mix. Earlier this summer, the data giant announced that third party cookies – and thus pixel tracking – will be phased out by 2022.

For brands that are reliant on the Google ad network, this could spell trouble. Google’s display network reaches 90% of internet users worldwide. So advertising on websites, news pages, blogs, Gmail, and YouTube, will all be affected.

But the implications are more far-reaching than that alone.

How Online Advertising Has Functioned

The barrier of entry to start running online ads is the lowest it’s ever been, as Google and Facebook have made it as easy as a few clicks to get started.

Display advertising has worked like this: create an ad, set your audience, set your budget. No tech skills needed. Easy peasy.

Profiling by attributes – like inferred/explicit demographics (who someone is), interests (types of things they like judged by online engagement), and behaviors (browsing and purchase history) – have been the primary variables guiding ad placement. These platforms also serve ads to groups of people based on who else engages. This is basically look-a-like targeting and has helped the tech giants more readily scale relevant ad placement.

| How is Demographic, Behavioral, and Interest Data Obtained? |

| Let’s say Pete sees an ad for Puma soccer shoes. He clicks on the ad. But why? Why was he shown that ad, and why did he have a higher-than-average propensity to click? Sites and search engines aggregate interests from individuals. They’re not looking at what Pete’s doing on one website, but all properties they monitor and measure – which is almost everything. Pete’s digital footprint encompasses every search engine result, every blog read, sports site visited, YouTube video watched, Instagram ad interacted with, and Facebook post liked. Every piece of content on Google and Facebook is designed to build profiles of people based on what they interact with. It’s less about Pete and more about what he’s interested in… advertising has been about a profile, not a person. Then, demographics can be inferred because certain types of profiles like certain content. Pete saw this ad because there’s a data provider who aggregates lots of pieces of information from lots of cookies on different properties. Then, an agency finds “people who look like this.” They know who will respond based on data. Since Pete is on Sky Sports, NFL.com, and likes football-related Facebook posts, a picture of who he is has been painted without ever needing any login, email address or further information. |

There’s an entire digital supply chain and ecosystem around the collection, sharing, and brokering of this information, which is how advertising works. The online ad world isn’t about names and email addresses, but inferred behavior and demographics.

How is it all scaled? Brands are working with third parties to share data, signals, and anonymous IDs across the entire world wide web using cookies.

Cookies, cookies, and more cookies

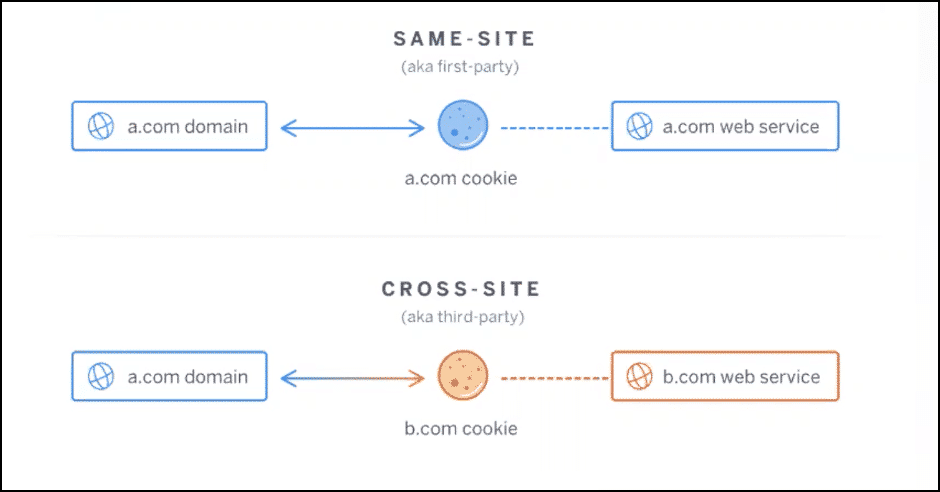

Cookies track web visitors and assign attributes based on what they do on a website. Cookies are pieces of script dropped on people’s machines/devices and they collect information. A first party cookie is only collecting information about what a consumer is doing on that website. A third-party cookie is tracking and sharing across sites. But, cookies are connected.

Are you searching for new shoes, browsing self-help books, watching sports, applying for credit cards, buying a new toaster, engaging with political content, downloading ebooks on fitness, or visiting a dating app? Cookies track it all. Many websites have thousands, especially media sites.

Cookies are linked – to one another, other properties, and other companies – so data can be shared and advertising effectiveness can be quantified, measured, and understood. The Internet is flooded with these cookies and the digital supply chain is entirely, almost hopelessly, reliant on cookies and the data-sharing they enable.

Again, this isn’t happening on one website. It’s happening everywhere.

With recent uproars around data privacy, customer data, and online tracking, third party cookies have come under greater scrutiny while first-party cookies have moved to permission based.

Increased attention from consumers and pressure from legislators are making data captured from third-party cookies unreliable. Governments across the globe are putting pressure on Google, Apple (didn’t have much to lose from data monitoring), Facebook, and Microsoft to disable access of cookies by default across browsers, devices, and platforms.

Apple did make a pivot with IDFA, and starting with iOS 14, any app that wants to use an identifier for advertisers has to obtain expressed consent from a user, which means users will have to give permission to be tracked across apps. Unless they say “ok,” cross-app identifiers will go extinct.

Google has publicly said they will do away with cookies and customer identity matching over the next two years.

All these changes together are going to change the entire industry like never before.

What’s the Problem?

With the loss of third party cookies, advertising spend is expected to go down or at least shift as measurement and attribution will become unreliable at best and absent at worst.

Apple’s Safari and Mozilla’s Firefox have already blocked cookies by default.

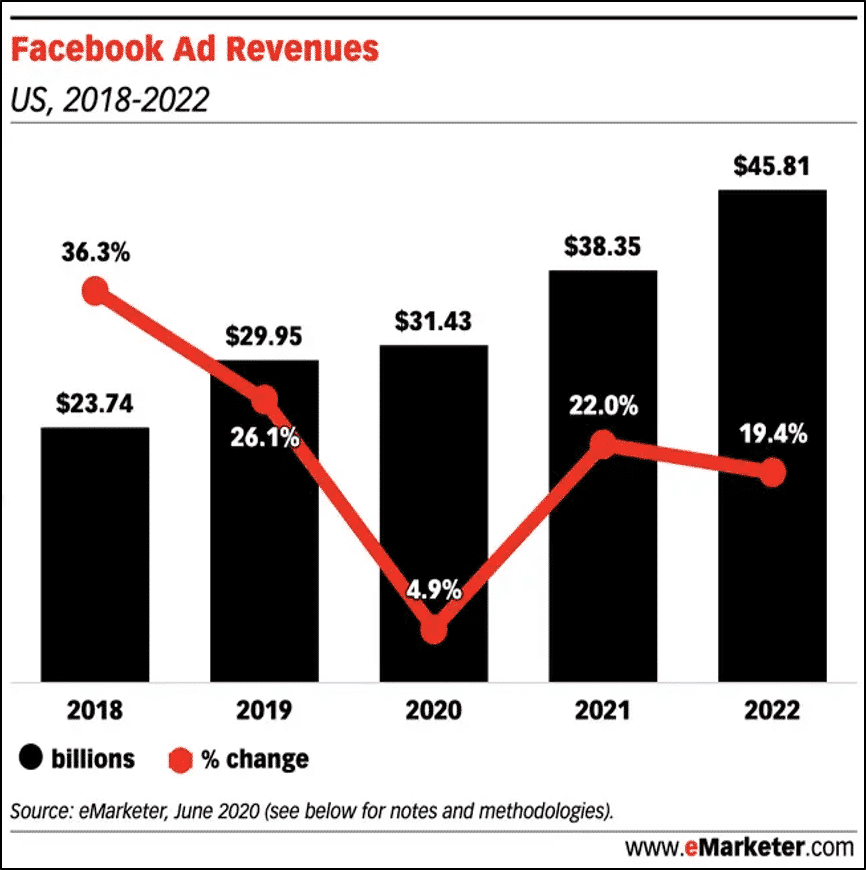

Facebook and Google are different because they have a duopoly on the online ad market. Together, they account for USD $333 billion annual spend on ads, and the foundation upon which it’s all built – cookie-based advertising – is about to come crashing down.

Google – which will take a phased approach, beginning by offering more detail within its “why this ad?” listings – predicts that without third-party cookies, publisher revenues would drop an average 52% on its platform. Facebook is in the same boat:

This issue will be accentuated for advertisers and marketers whose ad budget is spent predominantly on acquisition. Therefore, brands with an emphasis on getting new customers in (but not necessarily on keeping the ones they have) may face conversion problems if they do not adapt.

We see four primary technical problems:

▸ Cookies will no longer be supported across all the main browsers

▸ Previous behavioral and sales data may become unreliable

▸ We’ll see incomplete matching and low identity resolution across channels

▸ Marketers will need to do case-by-case consent management for each cookie-less integration with a marketing platform or advertising network

And we view the business risks as being threefold:

▸ 1:1 marketing will become more difficult. Brands will face challenges in identifying who their customer is in a GDPR and CCPA-compliant way.

▸ Advertising methods that used to work will be replaced. Old ad campaigns may now become ineffectual and CRM ads will become less effective.

▸ Achieving ROAS and improving business outcomes will become more tricky. These may lead to an inability to justify advertising spend, therefore reducing return.

While marketers aren’t as exposed as the big tech giants, they will need to adapt in kind and understand their options. That’s what the next two posts in this series will explain.

Final Thoughts

The demise of cookies honestly isn’t all that surprising. It has been anticipated for a while now, and a new and brighter future in a cookie-less world is on the rise.

Permission-based marketing is by far the way of the future for advertisers. Marketers have no choice but to take consent, data protection, and ad transparency seriously. All of our brands’ well-being depends on how well we come together around these ideas.

Stay tuned for PT II and PT III of this series where we’ll cover how to use first-party data (data you own) to focus on retention, retargeting, re-subscription, and lifecycle marketing to drive profitable growth.

Take the Next Step and Learn How to Truly Get the Most of Your Customer, Product, and Sales Data in Our New e-Book!

Handpicked Related Content: