- Plattform

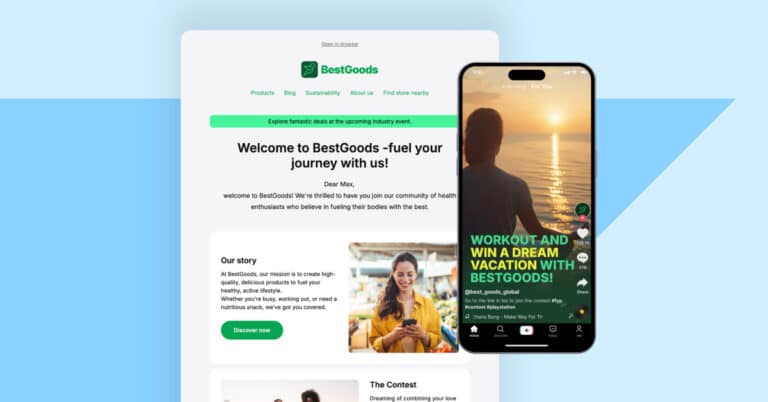

Plattform Übersicht

Sehen Sie, wie SAP Emarsys Marketingexperten dabei hilft, KI-gestützte personalisierte Omnichannel-Interaktionen bereitzustellen, die Geschäftsergebnisse erzielen.

Mehr dazu- Wichtigste Funktionen

- Kanäle

- Lösungen

Lösungen entdecken

Entdecken Sie, wie die Customer Engagement-Plattform von SAP Emarsys Marketer aus verschiedenen Branchen dabei unterstützt, personalisierte Erlebnisse bereitzustellen.

Mehr dazu - Erfolgsgeschichten

- Unternehmen

Warum SAP Emarsys

Unsere Mission ist es, das Mögliche für Marketer neu zu definieren, indem wir KI-gestützte Lösungen liefern, die Kunden begeistern und phänomenale Ergebnisse erzielen.

Mehr dazu - Partner

Partner Connect Ecosystem

Erfahren Sie, wie SAP Emarsys mit Technologie- und Lösungspartnern zusätzliche Möglichkeiten für Wertschöpfung, Umsatzströme, Skalierbarkeit und Innovation schafft.

Mehr dazu - Ressourcen