Where Black Friday used to be the official kickoff of the end-of-year shopping season, we see more brands offering incentives to buy ahead of Black Friday and the Cyber 5 (the five-day period between Thanksgiving and Cyber Monday).

Some brands have sales as early as Halloween. Others hold unofficial Black Friday sales in the week and days leading up to Thanksgiving.

But is this focus on Black Friday, the Cyber 5, and the weeks leading up to them actually a good thing? The earlier you get shoppers to load up on gifts, the less likely it is that they’ll come back to buy more in December. Shoppers are essentially being trained to go wherever the sales are and hold out for big discounts.

This is a growing problem. Brands clamor for shoppers by one-upping each other on discounts, deals that are great for customers but that can seriously damage a brand’s margins.

However, there are strategies you can employ to walk that tightrope between treating customers the way they want to be treated and yet still bringing in revenue in November and December.

The Draw of Black Friday and the Cyber 5

For shoppers, it’s a combination of saving money on big discounts and getting shopping done early, primarily online and increasingly with mobile. In 2018, the Cyber 5 weekend brought in $24.2 billion in total online sales, up an astounding 23% from the previous year, and customers spent $313 on average, down slightly from 2017.

Cyber 5 2018

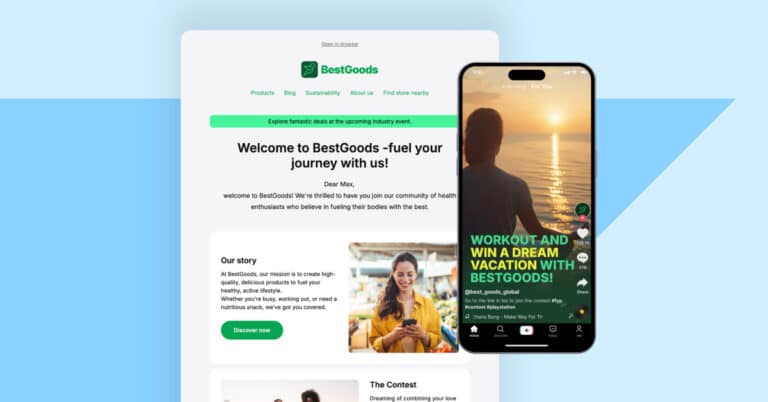

Internet Retailer’s The Cyber 5 2018 Report shows how both the Cyber 5 rose above previous years in sales and how more retailers are kicking off their holiday season ahead of Thanksgiving.

The reason both brands and consumers spend so much energy on Black Friday through Cyber Monday is because… well, because we’ve trained ourselves to do that over the past decade and a half, and it continues to be a great opportunity for consumers to get a deal and for brands to attract both new and existing customers.

2018’s numbers show that the weekend is still growing with Cyber Monday being the single biggest day of online shopping ever:

Cyber 5 2018 Sales and Growth

| Thanksgiving | $3.7 billion | 28% growth YoY |

| Black Friday | $6.22 billion | 23.6% growth YoY, second only to Cyber Monday in sales |

| Saturday | $3 billion | 25.5% growth YoY |

| Sunday | $3.4 billion | 25.6% growth YoY |

| Cyber Monday | $7.9 billion | 19.3% growth YoY, single biggest day of online shopping ever |

But the report also shows that brands are experimenting with pre-Cyber 5 sales. In the U.S., online sales in the first nine days of November 2018 went up 13.3% over the previous year. Then online sales went up to 25.7% from November 10th through the 12th.

Many retailers also have been extending one-day-only sales, the foundation of Black Friday when it first became the shopping event it is today way back in 2005. Some sales start Thanksgiving Day, and over the last couple years, we’ve seen more brands extending their sales past Cyber Monday and lasting the entire next week.

A 2018 NerdWallet survey shows just how well-conditioned we are to accept nothing but big incentives Black Friday through Cyber Monday where 54% of shoppers expected to use discounts and promotional codes for their holiday shopping. A National Retail Federation and Prosper Insights & Analytics survey found that over 33% of shoppers are planning to complete 100% of their holiday purchases were sale purchases.

Source: NerdWallet.

Cyber 5 2019

Looking ahead to this year’s Cyber 5, 44% of consumers plan to capitalize on discounts on Black Friday, and 53% plan the same for Cyber Monday. In terms of discount, about a fourth of all shoppers believe that 25% off is the lowest incentive they’d find valuable. Recent research reveals that 70% of shoppers won’t part with their money for anything under 31% off.

What does all of this discount frenzy mean for retailers? As a RetailMeNot survey shows, 76% of retailers will offer even more sales and discounts this year than in 2018.

So that’s how we got here — where a brand feels compelled to continue upping the discount to beat out the competition. And there’s no sign that this will stop — even as sales threaten to wreck a brand’s margins.

The Incentive Dilemma

Customers won’t show up during the holidays unless you give them a pertinent reason to, hence, the discount war you see every Black Friday through Cyber Monday. If you don’t offer a 40% discount, your competitor will and may go even further with a 50% off coupon.

This has been the conventional wisdom up to now, but this escalating incentive trend has caused some real problems for brands in the past.

For example, take the retailer Best Buy. In the early 2000s, they had a policy of matching a competitor’s online price, but this led to declining margins. In 2010 and 2011, Best Buy had a margin of 4.8% which dropped to 2.1% in 2012, and then plummeted to -0.3 percent in 2013.

So whether it’s matching prices or upping the incentive ante, steep discounts can be quite risky for a brand’s bottom line, especially if they’re using holidays as a way to recoup losses from earlier in the year — as a sort of desperate liquidation sale.

Some shoppers perceive that desperation as commentary on a low-value product. They turn to other brands with smaller discounts, assuming those brands are better quality.

Super-deep discounts also cause problems for a brand’s loyal customers. They’ve been buying full price from you all year, and now these huge discounts meant to attract new customers make them feel like they don’t matter so much to your brand.

Attracting Customers Without Killing Your Margins

Discounts work. Especially on Black Friday and Cyber Monday. They help you bring in new customers and drive up AOV. But do they have to be as deep as 30%? Or %40?

Depending on who you talk to, 20%-25% is the sweet spot. 10% off won’t stand out during the holidays. A 40% to 50% discount will resonate with customers, but you have to plot out your profit margins carefully. Half off can destroy your bottom line.

Use your customer data to target customers with the right discount, the minimum % off to get them to purchase, all based on previous shopping history. This gives the customer the personalized treatment she wants, and part of what she might want is a particular incentive rate. Not everyone needs as much as 20% or 25% off to purchase.

A CDP (Customer Data Platform) can significantly optimize your data processing. A CDP is generally a single platform that serves as a single source of truth about each customer. That data is a brand’s most valuable asset as well as the main personalization fuel for every holiday campaign.

Final Thoughts

We will see how holiday sales continue to evolve, because the customer continues to evolve. But as technology advances, e-commerce and retailers can better serve customers with predictive marketing, typically built on top of quality data and machine learning. That tech will also help marketers pinpoint the right Goldilocks incentive — not too high, not too low.

But the Cyber 5 do not appear to be going away anytime soon. The sales may expand to cover more than those five days in November, but Black Friday and Cyber Monday will remain important days for brands to connect with their customers.

Whether it’s retail or e-commerce, Emarsys can help you have a successful festive season. In 2018, the Emarsys platform had 100% uptime throughout the Cyber 5 weekend. That includes delivering over 520 million emails, over 20 million push messages, and over 50 million API calls on Black Friday. For more on our CDP and data-driven solutions we have to offer, check out a demo.

Handpicked Related Content: