As countries around the world remain in lockdown or consider easing COVID-19 restrictions, we continue to see a big shift to e-commerce, in part because consumers have been shopping from home more and more since mid-March.

Here are some of the top e-commerce trends we’ve spotted this week.

Nearly Half of Worldwide Online Sales for Brands Are from “New Customers”

A huge 43% of sales over the past month were made by first-time buyers, while the remainder of sales were made up of second-time buyers (5%), active repeat customers (23%), defecting customers (14%), and inactive customers (8%).

The data shows that it’s more important than ever to be able to quickly distinguish new customers from loyal ones, so you can target them with campaigns in the right way and do so quickly. Artificial intelligence can be a huge asset here because it can analyze your entire customer base quickly to determine who’s new and who’s loyal. Then, you can set up separate automated digital campaigns for each type of customer.

Video-Conferencing Is Driving Demand for Beauty Products

Many of us are working from home these days, and we still need to look good for all those Zoom meetings. This demand is driving considerable sales of beauty products across the world. Many products over the past month have seen triple-digit growth online compared with the same time last year. Online sales of lipstick are up 287%, as are sales for mascara (+275%), eyelash extensions (+195%), make-up brushes (+188%), and nail polish (+128%).

We can, perhaps, put some of this demand down to the “lipstick effect,” where in times of hardship and crisis, consumers purchase low-value luxury items to help them get through the situation — and the only way they can buy at the moment is online — but there are also brands (Adore Beauty and MECCA) who have done well with higher price beauty items especially when they’re able to provide the in-person beauty experience online.

American Fashion Retailers Are Seeing a Boost in Revenue

As the US slowly starts reopening non-essential businesses, there seems to be a correlation between announced re-openings and an uptick in revenue for fashion and accessories retailers.

Could there also be a link between this increased revenue and masks? According to a recent article in The New York Times, experts are estimating that we may be required to wear masks in public places for up to a year. With many fashion brands pivoting their manufacturing to PPE (Personal Protective Equipment), there is significant press and marketing surrounding these efforts — Forbes and Today are just a few examples.

But masks alone do not equal revenue. The feeling of safety, social responsibility with “buy one/give one” initiatives, and empathy radiating from the retailers who have embraced this new normal are the main factors driving engagement and customer loyalty.

Australians Are Getting Used to Online Shopping

Compared to the rest of the world, Australians haven’t taken as much to online shopping, but the lockdown is set to permanently reshape consumer behavior within the country. According to Matt Wade of the Sydney Morning Herald: “This crisis has forced many people to get a login, open an account and work out how things work. And I don’t think they’ll ever go back.”

As a sign of the rapid shift to digital, e-commerce sales in Australia have greatly increased since the start of the pandemic, although overall consumer spending is down.

Data Insights (Week of April 27, 2020)

The Americas

North, Central, and South America continue to see YoY growth in e-commerce sales. US fashion retailers report online revenue is up 88% YoY, and online orders are up 105% over the previous year. Even better, pure-play brands in Mexico are seeing orders up 200%.

This week we’ve heard that the US is planning to reopen businesses slowly, and as a result, fashion and accessories retailers are seeing an online revenue lift of +84% YoY.

Revenue Growth Leaders at a Glance

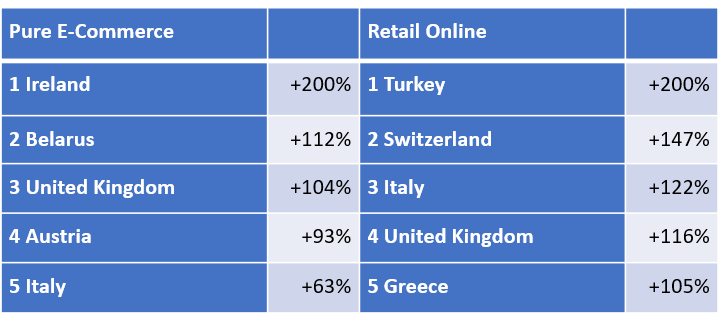

Europe

Austria was one of the earliest countries to go on lockdown. As a result, the Austrian shift to e-commerce has delivered incredible growth (+159% in mid-April), even beating out Germany.

Now with some businesses reopening in Austria, the trend is that e-commerce will take a dip at first — all the more reason to onboard new customers now and plan a long-term retention strategy. The bigger issue will be how Austrian e-commerce performs after stores are open again.

Revenue Growth Leaders at a Glance

Asia Pacific

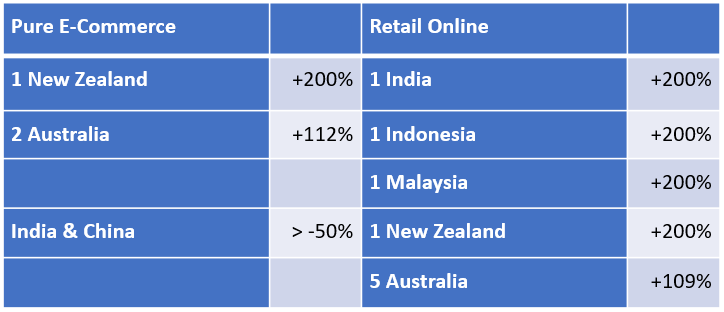

Australian fashion and accessories retailers who have shifted sales online have seen over 70% increases in revenue YoY.

With e-commerce sales in New Zealand up 115% YoY — they were as high as 189% in mid-April — it will be interesting to see what happens in the wake of the government lifting COVID-19 restrictions this week.

Revenue Growth Leaders at a Glance

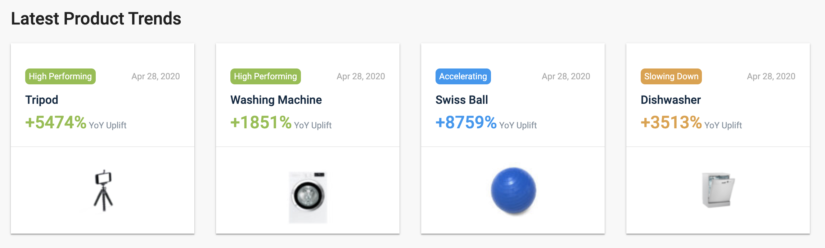

Top Product Trends

Key Product Trend Insights: Appliances are the top-selling products, with washing machines up 18X YoY and dishwashers (even though they’re slowing down this week) up 35X YoY. Athletic wear and equipment are also popular at the moment, with Swiss Ball seeing over 87X growth YoY this week. Meal prep and home improvement purchases are growing, too.

Growth Trends in Online Transactions

In the US, UK, Mexico, Australia, and parts of Europe, growth (in revenue and the number of orders) is good for brands who have shifted the most seamlessly to e-commerce-only. Of note, China’s economy is still making it hard for brands to grow revenue, perhaps due to the difficulties in reopening businesses.

Following are the growth trends we see this week, but you can explore Regional and Countries trends in more depth.

Trends by Region

Pure e-commerce: North American e-tailers are outperforming Europe and APAC in both revenue and orders.

Retail online: North American retailers have been the most successful in shifting to digital, and have the highest revenue in the last week, but orders in Europe are not far behind the U.S.

Trends by Country

Pure e-commerce: The United States and Australia have seen a downturn in revenue over the last few days, though US pure-play orders have stayed high throughout the month.

Retail online: The United States has remained strong in terms of revenue, but Australia recently beat out everyone else. Also of note, UK online retail has ended April above both the US and Australia in revenue.

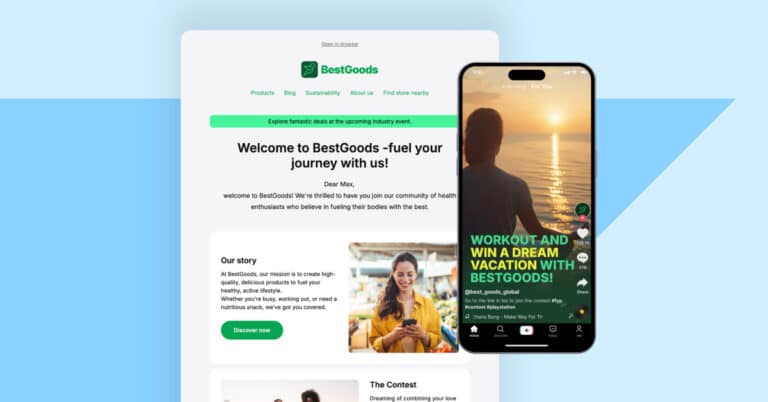

How Brands Are Adapting This Week

Prior to the pandemic, it was predicted that 80% of US sales would still happen in a store. Now with the shift to digital, consumers of all ages are shifting to e-com.

The shift to digital is going to have long-lasting effects for retailers, in some cases permanently altering the way they do business. However, the brands who have adapted a digital-first strategy the fastest are seeing big boosts in food (Sur La Table) and grocery, household essentials (A.S. Watson), and beauty products (Adore Beauty and MECCA). Success here depends on either offering a convenient service or product not available before, OR delivering an engaging customer experience through digital channels.

Handpicked Related Content:

- The Digital Marketing Life Preserver: How Brands Stay Afloat During COVID-19 by Prioritizing Online Retail and E-Commerce

- The COVID-19 Shift to Is Forcing Retailers to Change Forever

- Shift to Digital: How COVID-19 is Driving Consumers of All Ages and Demographics to Rapidly Embrace E-Commerce

CCINSIGHT.ORG | Data-Based Consumer Insights to Help Retailers Drive New Strategic Approaches to COVID-19